The Death and Rebirth of the

Caribbean Marketplace

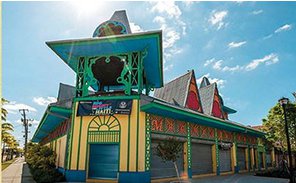

On July 18, 2014 the City of Miami hosted a reopening ceremony for the renovated Caribbean Marketplace in Miami's Little Haiti community The 9,500-square-foot facility will offer space for vendors specializing in but not limited to arts and crafts. A refreshment and concession area will have a distinctly inviting West Indian feel.

The facility was developed by the Haitian Task Force (HTF) in the 1980's and 90's which envisioned the project as being an indoor flea market housed in a distinctively designed building. With the huge surge in immigration from Haiti during the late 1970s and early 1980s, HTF envisioned a ti-machin, or flea market, ambience.

The project was sucessfully constructed but ultimately failed because over-optimitic revenue projections. The distinctive style of the building, which pays homage to Port au Prince’s charming gingerbread houses, won an American Institute of Architects national award and was profiled in Architectural Review magazine in November 1990. At the grand opening in 1990, 23 merchants were in place for business but the boom times did not come soon enough for the Caribbean Marketplace and financial problems overwhelmed the project. HTF had to covenvey the property to the City as part of a "friendly" foreclosure on its mortgage.

Local Initiatives Support Corporation

The Local Initiatives Support Corporation (LISC) is a national nonprofit that supports locally based nonprofit developers. When it first began operations in Miami-Dade County in the early 1980's LISC's highest priority project was HTF's Caribbean Marketplace. The vision for the project was largely shaped by the LISC employee who was serving as its point person for the project (she will go nameless for purposes of this article). She had a very much hands-on type of working relationship with HTF's original executive director (who also will go nameless). Important decisions all seemed to be made by LISC at times without bothering to get approval from HTF's board of directors.

The Property

There were eventually three parcels of real estate that comprised the "Caribbean Marketplace". They were:

- The original Caribbean Marketplace (5827 NE 2nd Ave.)

- The "Oasis" property, purchased in 1991 with funds from an HHS grant (5814 NE 2nd Ave.)

- The "Parking Lot" property (on NE 2nd across the street from the other two properties).

Caribbean Marketplace Property

The Caribbean Marketplace property was purchased in 1987 using funds obtained from a 1986 federal HHS grant (not to be confused with the subsequent 1990 HHS grant referred to below). At the time of the purchase the property consisted of two commercial retail buildings. To pay for the physical renovation necessary to convert the property, HTF borrowed $100,000.00 from LISC, $150,000.00 from the State of Florida and $150,000.00 from a consortium of banks led by Amerifirst (this last loan was later assigned to Peoples Bank which then reassigned it to the City of Miami). LISC was instrumental in the implementation of the Marketplace providing all of the necessary predevelopment money and consultants that were needed for the project.

HTF created a subsidiary corporation to own and manage the property. It was called the Caribbean Marketplace, Inc. (or "CMI" for short). Because CMI did not have a staff of its own, the new corporation contracted with HTF to provide management services.

The three construction loans were made directly to HTF with CMI signing the guarantees and executing the mortgages that were required by the lenders.

Failure of the Original Business Plan

The Marketplace building had an award winning designed based losely on the famous "iron market" of Port-au-Prince. It opened in 1989. The original business plan called for a daytime indoor flea market with no evening entertainment component. By 1991 the plan had failed. It was doomed from the start because CMI had been forced to charge high rents due to the relatively large debt load. Although it was HTF that had adopted this ill-fated plan, its substance was heavily influenced by LISC. None of the tenants were required to pay for their own leasehold improvements. All were given loans from HTF's revolving loan fund which had been funded by the Ford Foundation. The tenants were misled by glowing and unsupported projections concerning the expected volume of foot traffic.

>

>

As the original business plan unraveled, more and more of the tenants defaulted. While this was going on, HTF's executive director was giving the board of directors glowing reports about his plans to turn the Marketplace around. In the meantime, he and LISC, in an attempt to salvage the Marketplace, incurred new debt without board approval. One example was the $19,000 worth of lease-hold improvements done by Beauchamp Construction Company for the benefit of one or more of the prospective new tenants. There was no written contract evidencing this arrangement. The board was not informed about it. Everything was done with a "wink and nod". There was an understanding that the construction company would be compensated at a later date when it was awarded the contract for the construction of the proposed parking lot. The $19,000 for the leasehold improvements would buried in the parking lot's budget.

Another example of this desperation was the unauthorized debt that was incurred for the ill fated "Junior's Meat Market" which, for the one week that it was actually open, was a huge retail facility taking up about one fifth of the Marketplace building. The only products sold were to be fresh meats and chicken. Junior's was not required to pay for any leasehold improvements. LISC made an arrangement with a David Greene from Baltimore for the leasing of over $24,000 worth in freezer and refrigeration equipment. Neither the new executive director nor anyone on the HTF board of directors was informed about this lease. They found out about it only at a much later date. LISC, without authorization from HTF's board, retained an attorney for HTF. The attorney, however, answered to LISC and not HTF. The attorney demanded and received a settlement from the owner's of Junior's Market. HTF received only one half of the total settlement proceeds. It is not known what the attorney did with the balance.

Departure of Original Executive Director

The original executive director quit in a huff. He then proceeded to engage in a campaign to discredit HTF's board. It was part of his smoke screen to cover up his own failings in implementing the Marketplace venture.

A new executive director was hired. During his first month of his tenure there was no money for salaries because the former executive director, as part of his cover-up, had, without board authorization, diverted Dade Community Foundation administrative funds to pay for CMI's operating expenses.

Adoption of a New Business Plan

HTF adopted a new business plan. Unlike the first business plan there was no support from LISC which apparently believed the unsubstantiated allegations of the original executive director to the effect that certain HTF directors were corrupt ("mon pa" was the Creole term that he used).

The new business plan was adopted in May and June of 1991. The daytime retail component was totally restructured. Gone were the tiny flea market stalls. They were to be replaced with a large showroom filled with furniture, art, and crafts from the Caribbean. In addition, a restaurant and evening entertainment venture were included in the plan. A key ingredient was CMI's

newly acquired liquor license. There was only one problem. There was no working capital. HTF was faced with a dilemma. Should they give up and write the Caribbean Marketplace off or should they do everything that they could to save the it. It was decided to roll the dice and make an heroic effort to implement the new plan. Expenses were to be paid out of current receipts. For the goods to be sold in the show room, consignment arrangements were made with suppliers in Haiti. There was no room for error.

newly acquired liquor license. There was only one problem. There was no working capital. HTF was faced with a dilemma. Should they give up and write the Caribbean Marketplace off or should they do everything that they could to save the it. It was decided to roll the dice and make an heroic effort to implement the new plan. Expenses were to be paid out of current receipts. For the goods to be sold in the show room, consignment arrangements were made with suppliers in Haiti. There was no room for error.

Renovations were necessary to accommodate the new plan. Even though there was no working capital there was $60,000 available for renovation of the building ($30,000.00 from the City of Miami and $30,000.00 from the 1990 HHS grant). Urban Constructors Corporation was hired to do the renovations. The contract with Urban had no effective cost containment component. Predictably there were cost overruns. During the renovation, costs were allowed to escalated well beyond the amount of funds available. After the original $60,000.00 limit had been reached, the new executive director, without board approval, diverted about $30,000 of the HHS grant that had been earmarked for the construction of the parking lot and used it to pay to Urban. At the end of the renovations, there remained about $38,000.00 still claimed by Urban. Subsequently, Urban brought a lawsuit.

The second business plan failed because of two factors: the embargo of Haiti (which made it impossible to acquire the goods on consignment as had been planned) and cost overruns in the operation of the Marketplace during the first two months of operation.

The "Oasis" Property:

The 1990 HHS funds were used to acquire two additional parcels of land for the expanded Marketplace. These were the "Oasis" property and the "parking lot" property. The former Oasis Bar was located two doors to the south of the original Caribbean Marketplace building. The purchase price was $200,000. The purchase price was broken down into two promissory notes. One note was for the real estate and the other was for the business (which included a "4-COP" liquor license). The debt service payment on real estate note is $588.66 per month.

The real estate was taken in the name of HTF and the note was executed by HTF. The real estate included a large back lot which extended from CMI's parking lot on the north all the way south to NE 58th Street. HTF planned to use the combined back lot parcels as part of the "weekend festival" required by the 1990 HHS grant (i.e. an outdoor flea market with entertainment, food, and drink).

The Oasis building itself was leased to Jean Leonard for the expansion of his very successful Leonard's Supermarket.

The purchase price was for $162,000.00 (the appraised value). For the downpayment, HTF used $100,000 of its 1990 HHS grant. The balance was financed through the purchase money mortgage note given to the seller.

The purchase included the business located in the Oasis building. The business assets (including the liquor license) was taken in the name of CMI. It was paid for by CMI giving the seller a promissory note for $39,000. The monthly debt service payment on this note was $376.46. As collateral, the Seller retained a UCC security interest in the liquor license and a mortgage on the real estate. The mortgage was cross collateral for both notes (i.e. a default on either of the notes would allow the holder to foreclose on the real estate).

Liquor License

The State of Florida gave permission for the liquor license to be transferred to the original Caribbean Marketplace building for use in the new entertainment/restaurant venture. Eventually the license was canceled due to CMI's failure to renew it through the payment of the annual fee.

Parking Lot Property

The "Parking Lot" property (located directly accross the street from the Marketplace) was purchased in 1990 with a cash payment of $132,000.00 from the 1990 HHS grant. At the time of the purchase the property contained an abandoned hardware store. Soon after the purchase the original executive director quit. HTF was then informed by LISC that a contract has been entered into with Beauchamp Construction Company for the demolition of the building and the construction of the parking lot. This was the first that anyone on the board had heard of this alleged contract since no prior authorization had been given.

Because HTF's procedure manual called for competitive bidding of all such contracts, and because the price seemed high ($96,000), one of the directors planned to initiate a competitive process to select the contractor. At that point the LISC representative initiated a meeting with HTF's executive committee. She, in no uncertain terms, vehemently insisted that HTF must proceed with Beauchamp. She said that Beauchamp would sue HTF if another contractor was selected. What she failed to state was that LISC had previously persuaded Beauchamp to undertake $19,000 worth of unauthorized leasehold improvements at the original Caribbean Marketplace building and that these sums were to be secretly included in the parking lot deal (which explained the high price).

After meeting with a representative from Beauchamp, it was decided to proceed (Beauchamp, to their credit, was forthcoming with information on the leasehold improvements and they were surprised that HTF's board had not been informed). No contract was ever signed, however, because of continuing disagreements over the price. The first draft contract was "cost plus" and was presented to HTF during March of 1991. HTF was told that the price could probably be lowered somewhat if the contract was made "fixed fee". When the next draft was presented in July of 1991 it the price was $110,000.00 (!). Because of the sharp price increase, it was decided to go back to the "cost plus" approach. Beauchamp was supposed to redraft the contract but they never did.

In the mean while, the parking lot construction work by Beauchamp went on. The project was delayed by the need to get a zoning variance on the back portion of the parcel. HTF feels that Beauchamp did not pursue the zoning variance vigorously thus needlessly delaying the completion of the project.

HHS Audit Findings

As stated above, in November of 1991 HHS funds that had been earmarked for the parking lot construction were diverted to pay Beauchamp for the leashold improvements it had constructed to the interior of the original Marketplace Building. It was like robbing Peter to pay Paul. Because of this there were now insufficient funds to pay the full amount owed on the parking lot construction contract. Work on the parking lot halted. Beauchamp latter sued on two counts: mechanic's lien and breach of contract.

HHS issued an audit report finding that some of the funds should be reimbursed to the federal government because some of the "parking lot" funds were used for interior renovations of the Marketplace building.

Death and Rebirth

A number of collection lawsuits were filed including those by the above mentioned building contractor. In the end HTF agreed to voluntarily convey the property to the City of Miami through a deed-in-liue-of-forclosure.

Eventually the City expanded the Marketplace structure by building a new addition on the rear portion of the property and rebranding it as the Little Haiti Cultural Center but the original Marketplace has been vacant since the City first took title years ago.

On July 18, 2014 the City of Miami hosted a reopening ceremony for the renovated Caribbean Marketplace. The 9,500-square-foot facility will offer space for vendors specializing in but not limited to arts and crafts. A refreshment and concession area will have a distinctly inviting West Indian feel.